Michigan drivers face one of the most challenging realities in the nation: some of the highest car insurance rates. The state’s no-fault insurance system, designed to protect drivers, has inadvertently contributed to these hefty premiums. However, the landscape is shifting, and savvy motorists can now unlock more affordable options. Understanding the nuances of Michigan’s insurance market is crucial for drivers looking to save money while ensuring they have the coverage they need.

Toc

- 1. Navigating Michigans Unique Car Insurance Landscape

- 2. Cheap Car Insurance Michigan: Top Providers and Rates

- 3. Related articles 01:

- 4. Strategies to Save on Car Insurance in Michigan

- 5. Related articles 02:

- 6. Cheap Car Insurance Options for Specific Drivers in Michigan

- 7. FAQs

- 7.1. Q: What is the average cost of car insurance in Michigan?

- 7.2. Q: How can I get the cheapest car insurance rates as a young driver in Michigan?

- 7.3. Q: What are the most affordable areas for car insurance in Michigan?

- 7.4. Q: How can married couples in Michigan get the cheapest car insurance rates?

- 7.5. Q: How can I find affordable car insurance if I have a DUI or other driving violations?

- 8. Conclusion

Unraveling the No-Fault Insurance System

Michigan’s no-fault insurance system means your own provider is responsible for covering medical expenses and lost wages, regardless of who was at fault in an accident. This system is unique in the U.S. and aims to provide swift compensation for injured parties without the need for lengthy legal battles. However, this safety net comes at a cost. The combination of high minimum coverage requirements and the no-fault system has led to some of the highest car insurance premiums in the country.

Michigan’s no-fault insurance system has undergone significant reforms in recent years, offering drivers more flexibility in choosing their coverage levels. Drivers can now select from various levels of Personal Injury Protection (PIP) coverage, with options ranging from $50,000 to unlimited coverage. This flexibility allows drivers to tailor their insurance to their needs and budgets. However, it’s essential to understand the implications of selecting lower coverage levels, as this could affect your financial protection in the event of a severe accident.

Factors Shaping Car Insurance Rates in Michigan

Several key factors influence the cost of car insurance in Michigan, including your age, driving record, vehicle type, location, and credit score. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

Age and Driving Experience

Younger, less experienced drivers often face the highest rates due to their increased risk on the road. Insurance companies consider younger drivers statistically more likely to be involved in accidents, leading to higher premiums. For instance, an 18-year-old driver in Michigan may pay 2-3 times more than a 40-year-old with a clean driving record, according to a 2023 study by the Insurance Information Institute.

Driving Record: A Closer Look

Your driving history plays a critical role in determining your insurance rates. A clean driving record can save you money, but even minor violations like speeding tickets can significantly impact your premiums. For instance, a speeding ticket in Michigan can increase your insurance costs by 15% to 25%, depending on the severity of the violation and your insurer. A more serious offense like a DUI can lead to a 50% to 100% increase in premiums. Accidents, even if you’re not at fault, can also lead to higher premiums. If you’re involved in an accident, your insurer will likely increase your rates, even if you weren’t responsible for the collision. This is because insurance companies see accidents as a sign of increased risk.

Vehicle Type: Safety Features Matter

The type of vehicle you drive can also impact your insurance costs. Generally, more expensive cars or those with high-performance capabilities tend to come with higher insurance premiums. However, modern cars often come equipped with advanced safety features like anti-lock brakes, electronic stability control, and lane departure warning systems. These features can reduce the severity of accidents and potentially lower your insurance premiums. Some insurers offer discounts for vehicles with these safety features. When shopping for a car, consider how the vehicle’s make and model will affect your insurance rates.

Location

Where you live significantly affects your car insurance rates. Urban areas like Detroit often have higher rates due to increased traffic congestion, higher crime rates, and a greater likelihood of accidents. In contrast, rural areas typically enjoy lower premiums. If you’re considering relocating or purchasing a vehicle, research the average insurance rates in your desired area to make an informed decision.

Credit Score

In Michigan, insurers can consider your credit score when determining your premiums. A higher credit score often correlates with lower insurance rates, as insurers view individuals with good credit as lower-risk customers. If your credit score is less than stellar, consider taking steps to improve it before shopping for car insurance.

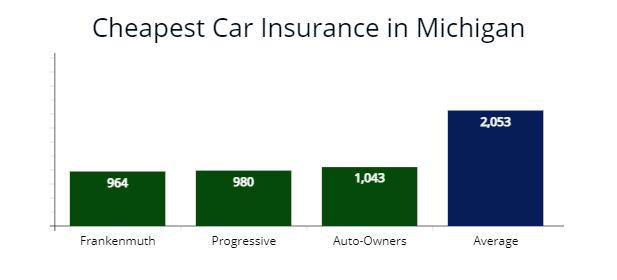

Cheap Car Insurance Michigan: Top Providers and Rates

When it comes to finding the most affordable car insurance in Michigan, several insurers stand out. Here’s a closer look at the top providers that offer competitive rates and valuable coverage options:

2. https://alightmotion.top/cheap-car-insurance-for-new-drivers-save-money-get-on-the-road/

3. https://alightmotion.top/finding-the-best-term-life-insurance-for-your-family-a-comprehensive-guide/

4. https://alightmotion.top/find-cheap-car-insurance-in-tn-a-comprehensive-guide-for-young-drivers/

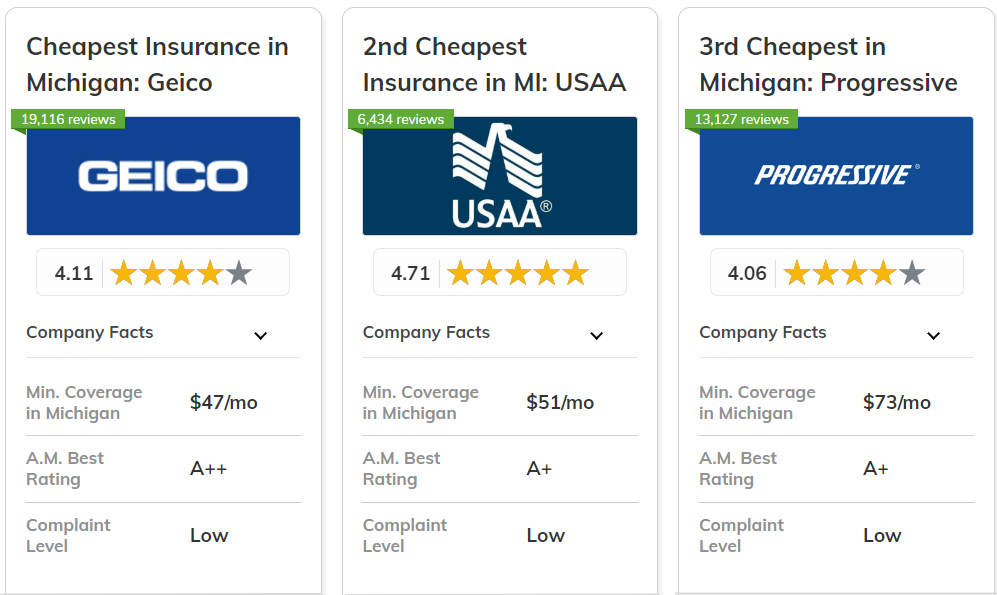

Geico: Best Overall Value

Geico consistently offers some of the lowest rates in the state, with minimum coverage starting as low as $47 per month. The insurer’s extensive discount program, which includes savings for safe driving, multiple policies, and military service, makes it an attractive choice for budget-conscious Michigan drivers. Additionally, Geico’s user-friendly online tools allow customers to manage their policies efficiently, making it easy to file claims and access important information.

USAA: Best for Military Members

Exclusively available to military members, veterans, and their families, USAA provides excellent rates and personalized benefits for its policyholders in Michigan. With minimum coverage starting at $51 per month, USAA is a top pick for those who qualify. The insurer is renowned for its exceptional customer service and claims handling, making it a trusted choice for military families seeking affordable coverage.

Progressive: Best for Online Management

Progressive’s digital-forward approach makes it easy for Michigan drivers to manage their policies and file claims online. The company’s competitive rates, starting at $73 per month for minimum coverage, and its Snapshot program (which rewards safe driving behavior with potential discounts) make it a popular choice. Progressive’s emphasis on technology and customer engagement sets it apart from other insurers, making it a convenient option for modern drivers.

Auto-Owners Insurance: Best for Young Drivers

Known for its affordable premiums, Auto-Owners Insurance offers minimum coverage in Michigan starting at $68 per month, making it a great option for young, budget-conscious drivers. The company provides various discounts tailored specifically for younger drivers, helping them save money while building their insurance history.

State Farm: Best for Customized Policies

With its extensive network of local agents and a wide range of customizable policy options, State Farm provides personalized service and coverage to Michigan drivers. While its rates may be slightly higher than some competitors, starting at $100 per month for minimum coverage, the insurer’s financial strength and stability make it a reliable choice. State Farm’s commitment to customer service and community involvement further enhances its reputation.

Beyond the Big Names: Exploring Smaller Insurers

While large, national insurers like Geico and Progressive often dominate the market, don’t overlook smaller, regional insurers. These companies may offer competitive rates, especially for drivers with good driving records and unique needs. Research local insurers in your area to see if they provide better rates than the national players. Remember that insurance rates can vary significantly between providers, even for the same coverage. It’s crucial to compare quotes from multiple insurers before settling on a policy. Online comparison tools can make this process easier and faster.

Strategies to Save on Car Insurance in Michigan

To maximize your savings on car insurance in Michigan, consider the following strategies:

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Take the time to get quotes from multiple insurers to ensure you’re getting the best rate for your specific needs. Online comparison tools can help you evaluate different options quickly and easily.

Increase Your Deductible

Raising your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can significantly lower your monthly premiums. However, it’s important to consider your financial situation. If you can’t afford to pay a high deductible in the event of an accident, it’s not worth the risk. Choose a deductible that you can comfortably manage without putting yourself in a financial bind.

Take Advantage of Discounts

Look for opportunities to save, such as good driver discounts, good student discounts, and multi-policy discounts for bundling your car insurance with other types of coverage. Many insurers also offer discounts for completing defensive driving courses or for having certain safety features in your vehicle.

Consider Usage-Based Insurance

Programs like Progressive’s Snapshot monitor your driving habits and can reward safe driving with discounts on your premiums. If you’re a cautious driver, usage-based insurance can be a cost-effective option that reflects your actual driving behavior rather than relying solely on demographic factors. Usage-based insurance programs, also known as telematics, are gaining popularity in Michigan. These programs use devices or smartphone apps to track your driving habits, such as speed, braking, and mileage. If you’re a safe driver, you could earn discounts on your premiums. Some insurers even offer discounts for driving during off-peak hours or for avoiding risky driving behaviors.

Review Your Coverage Regularly

As your life and driving situation change, make sure to review your car insurance coverage to ensure you’re still getting the best value. If you’ve recently moved, changed jobs, or purchased a new vehicle, it may be time to reevaluate your policy and explore new options.

2. https://alightmotion.top/cheap-car-insurance-for-new-drivers-save-money-get-on-the-road/

3. https://alightmotion.top/find-cheap-car-insurance-in-tn-a-comprehensive-guide-for-young-drivers/

4. https://alightmotion.top/finding-the-best-term-life-insurance-for-your-family-a-comprehensive-guide/

Cheap Car Insurance Options for Specific Drivers in Michigan

Young Drivers

Young drivers in Michigan face some of the highest car insurance rates due to their lack of experience on the road. However, there are ways to find affordable coverage for teen drivers. Geico consistently offers the cheapest car insurance for young drivers, with minimum coverage starting as low as $125 per month for 18-year-olds. The company’s extensive discount program can help offset the higher premiums associated with young drivers.

USAA also provides affordable car insurance options for teen drivers, with minimum coverage starting at $136 per month for 18-year-olds. For families with a military connection, USAA’s personalized benefits make it a top choice. Auto-Owners Insurance is another excellent option known for its affordable premiums for young drivers, with minimum coverage starting at $394 per month for 18-year-olds.

Married Couples

Married individuals often enjoy reduced insurance rates in Michigan, thanks to their perceived lower risk. Geico offers the cheapest car insurance for married couples in Michigan, with minimum coverage starting at just $51 per month. USAA provides excellent rates for military families, with minimum coverage starting at $65 per month. Progressive’s competitive rates and online management options make it a great choice for married couples in Michigan, starting at $89 per month for minimum coverage.

Senior Drivers

As drivers age, their insurance rates can fluctuate based on factors like driving history and age-related considerations. Geico offers the cheapest car insurance for senior drivers in Michigan, with minimum coverage starting at just $48 per month for 65-year-olds. USAA also provides excellent rates for senior drivers with a military connection, starting at $48 per month. Progressive’s digital-first approach and competitive rates, starting at $69 per month for 65-year-olds, make it a great choice for Michigan seniors who value online policy management.

FAQs

Q: What is the average cost of car insurance in Michigan?

According to our research, the average cost of full coverage car insurance in Michigan is around $4,067 per year, or $339 per month. This is significantly higher than the national average of $2,681 per year.

Q: How can I get the cheapest car insurance rates as a young driver in Michigan?

As a young driver in Michigan, you can find more affordable car insurance rates by comparing quotes from multiple insurers, maintaining a clean driving record, taking a defensive driving course, exploring good student and driver’s education discounts, and considering usage-based insurance programs that monitor your driving habits.

Q: What are the most affordable areas for car insurance in Michigan?

Some of the most affordable areas for car insurance in Michigan include Midland, Grand Haven, Spring Lake, Westphalia, and Eagle. Factors like lower crime rates, traffic density, and local regulations contribute to the more affordable insurance premiums in these regions.

Q: How can married couples in Michigan get the cheapest car insurance rates?

Married couples in Michigan can find the most affordable car insurance rates by comparing quotes from insurers like Geico, USAA, and Progressive, bundling their car insurance with other policies, and maintaining a clean driving record and good credit score.

Q: How can I find affordable car insurance if I have a DUI or other driving violations?

For drivers with a poor driving record, it’s crucial to compare quotes from various insurers, as some specialize in high-risk policies. Additionally, consider enrolling in rehabilitation programs or defensive driving courses, which may help lower your premiums over time.

Conclusion

Finding cheap car insurance in Michigan may require a bit more effort, but the potential savings are well worth it. By understanding the state’s unique insurance laws, exploring the top providers, and taking advantage of available discounts, Michigan drivers can secure the coverage they need at a price that fits their budget. Remember to shop around, compare quotes, and regularly review your policy to ensure you’re getting the best value for your money. With the right strategies and resources at your disposal, you can navigate Michigan’s insurance landscape and find affordable coverage that meets your needs.