Feeling overwhelmed by the burden of multiple debts and high-interest rates? You’re not alone. Millions of individuals struggle with managing various bills and finding a way to regain control of their financial well-being. However, there’s a solution that can help alleviate this stress: a debt consolidation loan calculator.

Toc

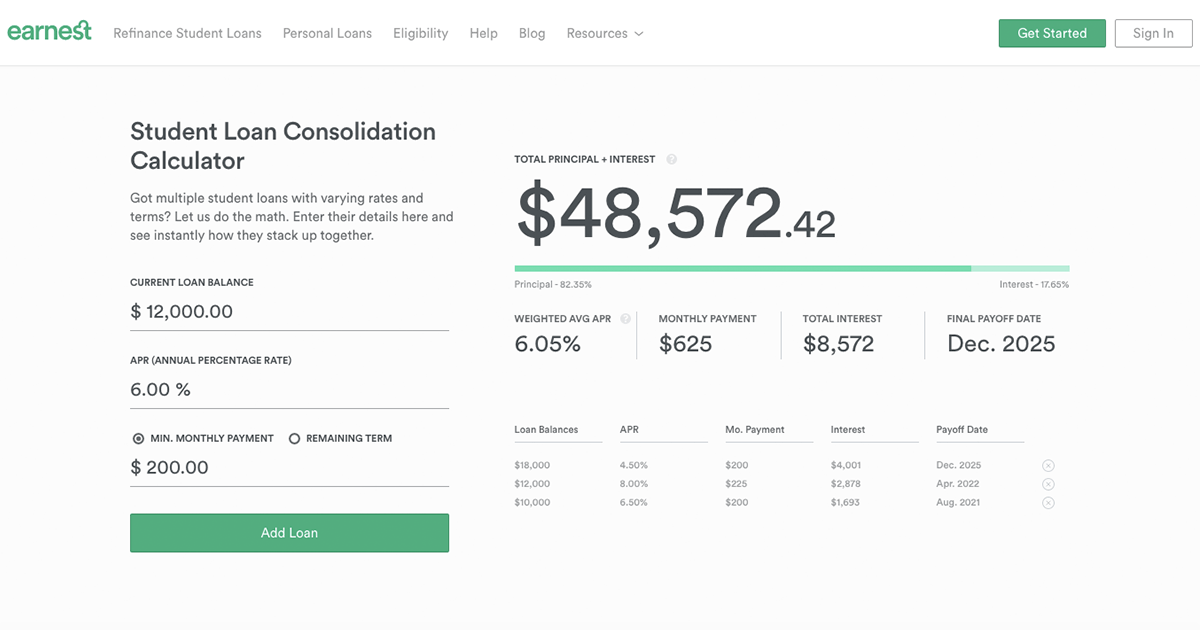

This powerful tool allows you to estimate your potential monthly payments, interest savings, and overall debt repayment timeline after consolidating your existing debts into a single loan. By inputting your current debt balances, interest rates, and loan terms into the calculator, you can gain a detailed snapshot of how debt consolidation could affect your financial well-being, revealing potential savings and helping you visualize your path to becoming debt-free.

Unlocking the Benefits of Debt Consolidation

A debt consolidation loan can simplify your payments, potentially lower your interest rates, and assist you in becoming debt-free faster. By exploring different scenarios using the calculator, you can make well-informed decisions about the best loan terms and repayment strategies to align with your financial goals.

Key Benefits of Using a Debt Consolidation Loan Calculator

- Clear Picture of Potential Savings: The consolidation loan calculator allows you to input the details of your current loans, including balances, interest rates, and remaining terms. It then calculates your current total monthly payment and projected total interest paid over the life of each loan. You can then compare this to the estimated monthly payment and total interest for a consolidated loan. This comparison highlights the potential savings, helping you decide if debt consolidation aligns with your financial goals.

- Informed Decision-Making: By analyzing the calculator’s output, you can make well-informed decisions about the best loan terms and repayment strategies to achieve your financial objectives. The loan consolidation calculator allows you to adjust variables like the loan term and interest rate to see how these changes affect your monthly payment and total interest. This lets you explore different scenarios and find the combination that best fits your budget and financial goals. For example, you might discover that a longer loan term with a slightly higher interest rate results in a significantly lower monthly payment, which is more manageable for you.

- Comparison Shopping Made Easy: Many online debt consolidation loan calculators allow you to input information from multiple lenders simultaneously. This lets you quickly compare interest rates, fees, and other terms side-by-side. This feature is especially helpful when shopping for loans from different institutions, as it makes it easy to identify the best offer based on your specific needs and preferences.

- Avoiding Unforeseen Costs: Understanding the potential interest charges and fees upfront helps you avoid unexpected costs and surprises down the road. This foresight can prevent you from falling into further debt traps due to hidden fees.

Additional Benefits

In addition to these key benefits, using a debt consolidation loan calculator can also help you:

- Track Your Progress: As you make payments on your consolidated loan, you can use the calculator to track how your debt decreases over time. This can motivate you to stay on track with your repayment plan.

- Enhance Financial Literacy: Engaging with the calculator enhances your understanding of how loans work, the impact of interest rates, and the importance of managing debt responsibly. This knowledge can be invaluable in your future financial endeavors.

- Customize Your Repayment Plan: With the flexibility to adjust variables in the calculator, you can customize your loan terms and repayment plan to fit your unique financial situation. This allows you to find a solution that works best for you.

Choosing the Right Debt Consolidation Loan Calculator

When selecting a debt consolidation loan calculator, it’s essential to consider the following factors:

Accuracy

When choosing a debt consolidation loan calculator, ensure that the tool is accurate and uses up-to-date interest rates and loan terms. An accurate calculator provides reliable data that you can trust to make significant financial decisions. Look for calculators from reputable financial institutions or websites that regularly update their tools to reflect current market conditions.

User-Friendly Interface

A user-friendly interface is crucial for seamless navigation and ease of use. The ideal calculator should have clear instructions, intuitive data input fields, and easy-to-understand results. A tool that is simple to operate encourages you to explore various scenarios and use the calculator more frequently to manage your finances better.

Comprehensive Features

Select a calculator that offers comprehensive features, including the ability to input multiple loans, customize loan terms, and compare different consolidation options. Some advanced calculators may also provide visual graphs and charts, which can help you better understand your potential savings and debt repayment timeline.

Credibility

Use calculators from credible sources to ensure that the results are reliable. Trusted financial websites, banks, and credit unions often offer high-quality tools. Reading reviews and seeking recommendations can also guide you toward credible calculators.

1. https://alightmotion.top/is-a-debt-consolidation-loan-a-good-idea-for-borrowers-with-bad-credit/

2. https://alightmotion.top/discover-consolidation-loan-simplify-your-debt-save-money/

3. https://alightmotion.top/using-a-personal-loan-to-pay-off-credit-card-debt-a-comprehensive-guide/

Debt Consolidation: Simplifying Your Finances

Debt consolidation involves taking out a single new loan to repay multiple existing debts, such as credit card balances, personal loans, or student loans. This consolidates your payments into a single monthly payment, potentially simplifying your finances and lowering your interest rates.

Potential Benefits of Debt Consolidation

The potential benefits of debt consolidation include:

- Lower Monthly Payments: By consolidating your debts, you may be able to secure a lower interest rate than what you are currently paying. This can result in lower monthly payments, making it easier to manage your budget. However, while debt consolidation can often lead to lower monthly payments, it’s crucial to remember that extending the loan term to achieve this can lead to paying more interest overall. If you are focused on paying off debt as quickly as possible, a shorter loan term with a slightly higher monthly payment may be a better choice.

- Simplified Debt Management: Managing multiple payments can be overwhelming. Debt consolidation simplifies your financial life by reducing the number of payments you need to make each month, allowing you to focus on one loan instead of several. However, debt consolidation simplifies payments, but it doesn’t address the underlying causes of debt accumulation. If you continue spending habits that led to debt in the first place, you may find yourself back in debt after consolidating your existing loans.

- Accelerated Debt Repayment: With a lower interest rate and a structured repayment plan, you may find it easier to pay off your debt more quickly than if you continued to make minimum payments on multiple accounts.

Considerations and Potential Drawbacks

However, it’s important to consider the potential drawbacks as well, such as:

- Higher Interest Rates for Poor Credit: If your credit score is low, you may not qualify for the best interest rates, which could lead to higher overall costs.

- Fees Associated with the Loan: Some lenders may charge origination fees or prepayment penalties, which can add to the overall cost of the consolidation loan.

- Risk of Refinancing Without Addressing Underlying Issues: Debt consolidation does not solve the underlying financial issues that led to debt accumulation. It’s crucial to address these issues to avoid falling back into debt.

Alternatives to Debt Consolidation Loans

In addition to debt consolidation loans, there are other methods for managing debt, such as debt management programs and balance transfer credit cards.

Debt Management Programs

Debt management programs (DMPs) involve working with a credit counseling agency to create a plan for repaying your debts. The agency negotiates with your creditors to secure lower interest rates or waive fees, and you make a single monthly payment to the agency, which then distributes the funds to your creditors. This can simplify your payments and potentially reduce the total amount you owe. However, DMPs may have fees associated with the service and can impact your credit score.

Balance Transfer Credit Cards

Balance transfer credit cards allow you to transfer high-interest debt from existing credit cards to a new card with a lower interest rate, often with a 0% introductory APR for a specified period. This can save you money on interest and help you pay down the balance faster. It’s important to factor in any balance transfer fees and to have a plan to pay off the debt before the introductory period ends, as the interest rate may significantly increase after that time.

Personal Loans

Another alternative is taking out a personal loan to consolidate your debts. Personal loans often have fixed interest rates and fixed repayment terms, providing predictability in your payments. These loans can be used to pay off multiple types of debt, including credit cards, medical bills, and other personal loans. However, qualifying for a favorable interest rate may depend on your credit score, and some lenders may charge origination fees.

Home Equity Loans

If you have significant equity in your home, a home equity loan or home equity line of credit (HELOC) could be an option for consolidating debt. These loans typically have lower interest rates compared to unsecured loans because they are secured by your home. However, using your home as collateral means that failing to make timely payments could put your home at risk of foreclosure.

Retirement Account Loans

Some retirement accounts, such as 401(k) plans, allow you to borrow against your savings. While this can provide immediate funds for debt consolidation, it comes with significant risks. Borrowing from your retirement savings can jeopardize your financial future and retirement plans. Additionally, if you leave your job, you may be required to repay the loan in full or face penalties and taxes.

Frequently Asked Questions (FQAs)

1. https://alightmotion.top/is-a-debt-consolidation-loan-a-good-idea-for-borrowers-with-bad-credit/

2. https://alightmotion.top/discover-consolidation-loan-simplify-your-debt-save-money/

3. https://alightmotion.top/using-a-personal-loan-to-pay-off-credit-card-debt-a-comprehensive-guide/

Q: Can I consolidate all of my debt into a single payment?

A: Yes, you can typically consolidate most types of debt, including credit cards, personal loans, and student loans, into a single loan. However, it’s important to note that some debts, such as secured loans or government-backed loans, may have restrictions on consolidation.

Q: Will debt consolidation affect my credit score?

A: Debt consolidation can temporarily affect your credit score due to the hard credit inquiry associated with applying for a new loan. However, if you make your payments on time and manage your debt responsibly, your credit score will likely improve over time as your debt balances decrease.

Q: How long does it take to get approved for a debt consolidation loan?

A: The approval process for a debt consolidation loan can vary depending on the lender and your financial situation. It typically takes a few days to a few weeks. It’s best to contact lenders directly to inquire about their specific approval timelines.

Q: What are some alternatives to debt consolidation loans?

A: Debt management programs and balance transfer credit cards can be alternatives, but they have their own pros and cons. Exploring all options can help you find the best fit for your financial situation.

Conclusion

Debt consolidation and its alternatives offer various pathways to manage and potentially reduce your debt. However, each option comes with its own set of complexities and risks. It is essential to thoroughly research and consider these factors before making a decision. Consulting with a financial advisor can provide personalized advice tailored to your specific financial situation and goals.

Ultimately, the most effective way to manage debt is to cultivate disciplined financial habits. Creating and adhering to a budget, avoiding unnecessary expenses, and setting aside savings can prevent debt from accumulating in the first place. Monitoring your credit score and understanding the terms of any loans or credit agreements are also critical steps in maintaining financial health.

Taking the time to understand your debt situation and considering all available options can empower you to make informed decisions that not only relieve your debt burden but also set you on a path to long-term financial stability. Whether through debt consolidation, alternative repayment strategies, or improved financial habits, committing to a proactive approach can make a significant difference in your financial well-being.