In a world where time is a precious commodity, the accounting industry has embraced the revolutionary potential of AI accounting software. These cutting-edge solutions are poised to reshape the way accounting firms operate, automating repetitive tasks and freeing up valuable time for high-impact client services. The advent of AI in accounting software is not merely a trend it represents a fundamental shift in how financial data is processed and analyzed.

Toc

For accounting firm owners, AI accounting software presents a remarkable opportunity to streamline workflows, enhance accuracy, and boost overall practice profitability. By leveraging the latest advancements in machine learning and natural language processing, these tools can automate data entry, reconciliation, invoice processing, and financial reporting, allowing accountants to focus on providing strategic guidance and building stronger client relationships. For example, AI can automatically extract data from invoices using OCR technology, eliminating the need for manual data entry. This can significantly reduce the time spent on bookkeeping tasks, allowing accountants to focus on more strategic activities. A study by the Association of International Certified Professional Accountants (AICPA) found that AI-powered data entry solutions can reduce data entry time by up to 80%.

The integration of AI into accounting practices has the potential to transform not only internal operations but also the client experience. As firms adopt AI, they can offer more responsive, personalized services that align with the evolving expectations of clients in today’s digital age. This guide explores the multifaceted benefits of AI accounting software, the top solutions available, and how to choose the best fit for your firm.

The Impact of AI on Accounting Firms

Increased Efficiency and Productivity

AI accounting software can save accounting firm owners countless hours by automating a wide range of tasks. From data entry and categorization to reconciliation and invoice processing, these intelligent tools can handle the heavy lifting, reducing the risk of human error and freeing up time for more valuable work. In fact, studies show that 59% of accounting professionals believe bookkeeping will be the most disrupted function by AI, paving the way for increased efficiency and productivity within the industry.

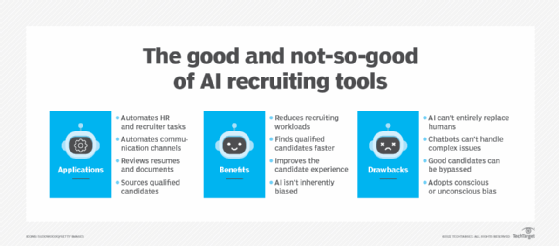

However, it’s important to acknowledge that the automation of tasks can also lead to job displacement for some accounting professionals. While AI creates new opportunities in areas like data analysis and consulting, it may also reduce the demand for traditional bookkeeping roles. This raises concerns about the future of the accounting workforce and the need for upskilling and retraining programs to ensure that accountants remain relevant in the evolving technological landscape.

The automation of routine tasks allows accountants to focus on higher-value activities, such as strategic planning and advisory services. By freeing up time from mundane tasks, accountants can dedicate their expertise to strategic planning, advisory services, and building stronger client relationships. This shift not only enhances productivity but also leads to improved job satisfaction among accounting professionals, as they can spend less time on tedious tasks and more time on engaging with clients and solving complex problems.

Improved Accuracy and Reduced Errors

Unlike humans, AI-powered accounting software is not subject to the biases and inconsistencies that can lead to errors in financial data. These intelligent systems use advanced algorithms to analyze large volumes of data, identify patterns, and catch potential anomalies or fraudulent activities with remarkable precision. For example, Vic.ai boasts of reducing invoice processing time by 80% while maintaining an accuracy rate of 97-99%, a testament to the power of AI in enhancing accounting accuracy.

Beyond simply automating tasks, AI can also play a crucial role in fraud detection. AI-powered systems can analyze transaction data in real-time, identifying patterns and anomalies that may indicate fraudulent activity. For instance, AI can flag unusual spending patterns, identify duplicate invoices, or detect discrepancies between bank statements and accounting records. This proactive approach can help firms prevent financial losses and maintain compliance with regulations.

The ability of AI in accounting software to detect anomalies significantly reduces the risk of financial fraud. By continuously monitoring transactions and flagging suspicious activities, these systems act as an additional layer of security for firms, ensuring compliance with regulations and protecting client assets. This proactive approach to fraud detection not only safeguards the firm’s reputation but also builds trust with clients, who increasingly expect transparency and accountability in their financial dealings.

Enhanced Client Service

By automating repetitive tasks, AI accounting software empowers accounting firm owners to provide even more personalized and attentive service to their clients. With real-time insights and AI-driven communication tools, firms can keep clients informed, respond to inquiries faster, and offer tailored strategic advice that drives business growth. Some accounting firms are even leveraging AI-powered chatbots to handle basic client inquiries, allowing their teams to focus on more complex issues and strengthen client relationships.

2. https://alightmotion.top/data-mining-tools-enhancing-business-intelligence-for-business-owners/

3. https://alightmotion.top/unlocking-efficiency-growth-with-legal-ai-tools-a-guide-for-attorneys/

5. https://alightmotion.top/data-rooms-the-key-to-enhanced-business-protection-and-efficiency/

AI can also personalize client communication, tailoring messages to their specific needs and preferences. For example, AI-powered tools can analyze client data to identify their key concerns and provide targeted advice. This personalized approach can strengthen client relationships and build trust, leading to increased client satisfaction and retention.

The use of AI in accounting enhances the client experience by providing timely and accurate information. For instance, clients can access real-time dashboards that reflect their financial health, enabling them to make informed decisions quickly. This level of transparency fosters stronger relationships between accountants and their clients, as firms can demonstrate their value through data-driven insights and proactive advice.

Understanding AI Accounting Software

Core Functionalities

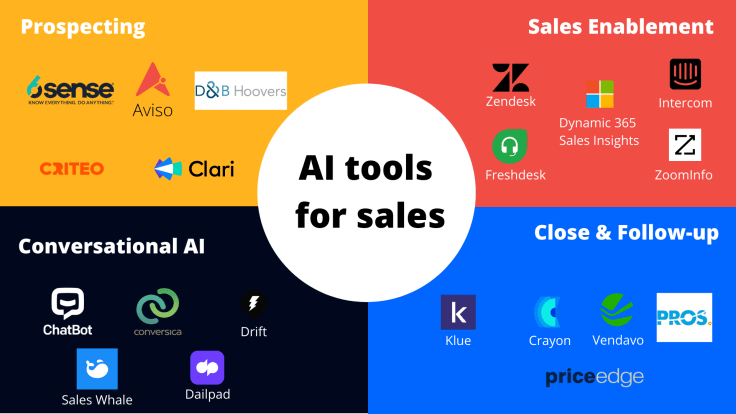

AI accounting software encompasses a variety of functionalities designed to streamline accounting processes. Key features include:

- Data Entry Automation: Utilizing optical character recognition (OCR) and machine learning, AI accounting software can automatically capture and input data from invoices, receipts, and other documents, reducing manual entry errors.

- Reconciliation: AI tools can automate the reconciliation of bank statements and accounting records, identifying discrepancies and ensuring accuracy in financial reporting.

- Invoice Processing: AI accounting software can process invoices from receipt to payment, managing accounts payable efficiently and minimizing delays in cash flow.

- Financial Reporting: Advanced algorithms enable the generation of comprehensive financial reports with minimal human intervention, providing insights that help firms make strategic decisions.

Types of AI Technologies Used in Accounting Software

AI accounting software leverages various technologies to enhance its capabilities:

- Machine Learning: This technology allows software to learn from historical data and improve its accuracy over time. It can identify trends and patterns that inform better decision-making.

- Natural Language Processing (NLP): NLP enables the software to understand and process human language, allowing for more intuitive interactions and the automation of tasks such as generating reports or drafting emails.

- Robotic Process Automation (RPA): RPA involves the use of software robots to automate repetitive tasks across different applications, allowing for seamless integration and improved efficiency.

Top AI Accounting Software Solutions

As the accounting industry continues to embrace AI, several standout AI accounting software solutions have emerged as compelling options for firm owners.

Financial Cents

Financial Cents is an accounting practice management software that seamlessly integrates AI features to boost efficiency and productivity. Its AI-powered email generation and workflow template creation capabilities allow accounting professionals to save time on routine tasks, while the platform’s intuitive interface and practice management tools make it a compelling choice for firms of all sizes.

- Pros: Easy to use, combines AI functionalities with practice management features.

- Cons: AI features are currently limited to practice management.

- Pricing: Solo Plan: $9/month per user, Team: $39/month per user, Scale Plan: $59/month per user.

- Free Trial: 14-day free trial.

Botkeeper

Botkeeper is an AI-powered bookkeeping and accounting solution that leverages machine learning and historical data to automate a wide range of tasks. From data entry and categorization to reconciliation and financial reporting, Botkeeper’s automated features can save accounting firms valuable time and resources.

- Pros: Time-saving, customizable, human-led approach.

- Cons: Steep learning curve, initial setup can be complex.

- Pricing: Accounting Partner Basic: $155, Accounting Partner Advanced: $215.

- Free Trial: Not available.

Karbon AI

Karbon AI is an AI-powered feature within the Karbon practice management software, offering accounting firms a seamless way to leverage the power of artificial intelligence. Karbon AI excels at tasks like email summarization, drafting, and providing personalized client updates, all while ensuring the highest levels of data security and industry-leading support.

- Pros: Directly embedded into Karbon, powered by Microsoft Azure OpenAI Service for data security, constant innovation, built by accounting industry experts.

- Cons: First version is primarily focused on email.

- Pricing: Contact Karbon for pricing information.

- Free Trial: Available.

Vic-ai

Vic.ai is an AI-powered accounting software solution that specializes in streamlining accounts payable workflows. From invoice processing to payment management, Vic.ai’s intelligent algorithms can significantly boost efficiency and accuracy, making it a valuable tool for accounting firms that handle a large volume of invoices and expenses.

- Pros: Strong emphasis on data extraction and compliance, customization options, handles large volumes of expense reports and data.

- Cons: High initial setup costs, limited integrations with less popular accounting software.

- Pricing: $1490.00 per month for the basic plan, Enterprise: Custom pricing.

- Free Trial: Not available.

Docyt

Docyt is an AI-powered accounting platform that automates a wide range of tasks, including data entry, invoice processing, and expense categorization. With its user-friendly interface and secure document storage features, Docyt can be a practical solution for accounting firms seeking to streamline their financial operations.

- Pros: Customizable, user-friendly interface, secure document storage.

- Cons: Not specific to accounting businesses, pricing for bookkeeping automation features can be costly.

- Pricing: End-to-end accounting plan: $299 per month.

- Free Trial: Available.

Emerging Trends in AI Accounting

The accounting industry is witnessing several emerging trends as AI technology continues to evolve and integrate into accounting practices.

Integration of AI with Blockchain Technology

The integration of AI with blockchain technology is a significant trend in accounting. Blockchain can provide a secure and transparent ledger for financial transactions, while AI can automate the analysis and reporting of blockchain data. This combination has the potential to revolutionize accounting processes, particularly in areas like supply chain management and auditing.

Expansion of Natural Language Processing (NLP)

The use of natural language processing (NLP) in accounting is rapidly expanding. NLP allows AI systems to understand and interpret human language, enabling them to process financial documents, generate reports, and even answer client questions in natural language. This development is making AI more accessible and user-friendly for accountants.

Increasing Adoption of Cloud-Based AI Accounting Software

The increasing adoption of cloud-based AI accounting software is another significant trend. Cloud-based solutions offer scalability, accessibility, and affordability, making them an attractive option for accounting firms of all sizes. The cloud also facilitates the sharing of data and collaboration between accountants and clients, further enhancing efficiency and communication.

Choosing the Right AI Accounting Software for Your Firm

When selecting the best AI accounting software for your firm, it’s essential to consider a range of factors to ensure a successful implementation and maximize the benefits.

Key Considerations

- AI Functionalities: Evaluate the specific AI features and capabilities offered by the software, and assess how they align with your firm’s needs. Look for tools that can automate the tasks that consume the most time in your practice.

- Integration: Ensure the AI accounting software seamlessly integrates with your existing accounting software and other tools used in your practice. Compatibility is crucial for smooth operations and data flow.

- Ease of Use: Consider the user-friendliness of the software and the learning curve involved for your team. A tool that is difficult to navigate can hinder productivity rather than enhance it.

- Price: Weigh the cost of the software against the value it provides in terms of increased efficiency, accuracy, and client satisfaction. Look for pricing plans that fit your budget while offering the features you need.

- Data Privacy and Security: Thoroughly research the software’s data retention policies, security measures, and any potential data usage for AI training. Protecting client information should be a top priority.

- Scalability: Ensure the AI accounting software can grow with your firm and adapt to your changing needs. As your practice expands, your software should be able to accommodate increased workloads.

- Customization: Evaluate the options for tailoring the software to your firm’s unique workflows and processes. Customizable features can enhance efficiency and ensure the software meets your specific requirements.

Tips for Implementation

- Start Small: Begin with a pilot project to test the software and gauge its effectiveness before a firm-wide rollout. This approach allows you to identify potential challenges and address them before full implementation.

- Train Your Team: Provide thorough training and ongoing support to ensure your team can utilize the AI accounting software to its full potential. Well-trained staff are more likely to embrace the new technology and maximize its benefits.

- Monitor Results: Continuously track the impact of the software on your firm’s efficiency, accuracy, and client satisfaction, making adjustments as needed. Regular assessments can help you fine-tune processes and optimize performance.

- Embrace Continuous Learning: Stay informed about the latest AI developments and best practices in the accounting industry to ensure your firm remains at the forefront of innovation. Networking with other professionals and attending industry conferences can provide valuable insights.

Conclusion

The rise of AI accounting software presents a remarkable opportunity for accounting firm owners to transform their practices and better serve their clients. By automating repetitive tasks, enhancing accuracy, and providing real-time insights, these intelligent tools can unlock new levels of efficiency and productivity, freeing up valuable time and resources.

As the accounting industry continues to evolve, it is crucial for firm owners to stay at the forefront of AI adoption and leverage the power of these cutting-edge technologies. By doing so, they can position their practices for long-term success, delivering exceptional client service and maintaining a competitive edge in the ever-changing landscape of the accounting profession.

In summary, AI accounting software is not just a tool; it’s a strategic partner that can help firms navigate the complexities of modern accounting. By embracing these technologies, firms can enhance their operational efficiency, improve client satisfaction, and ultimately drive growth in an increasingly competitive marketplace.